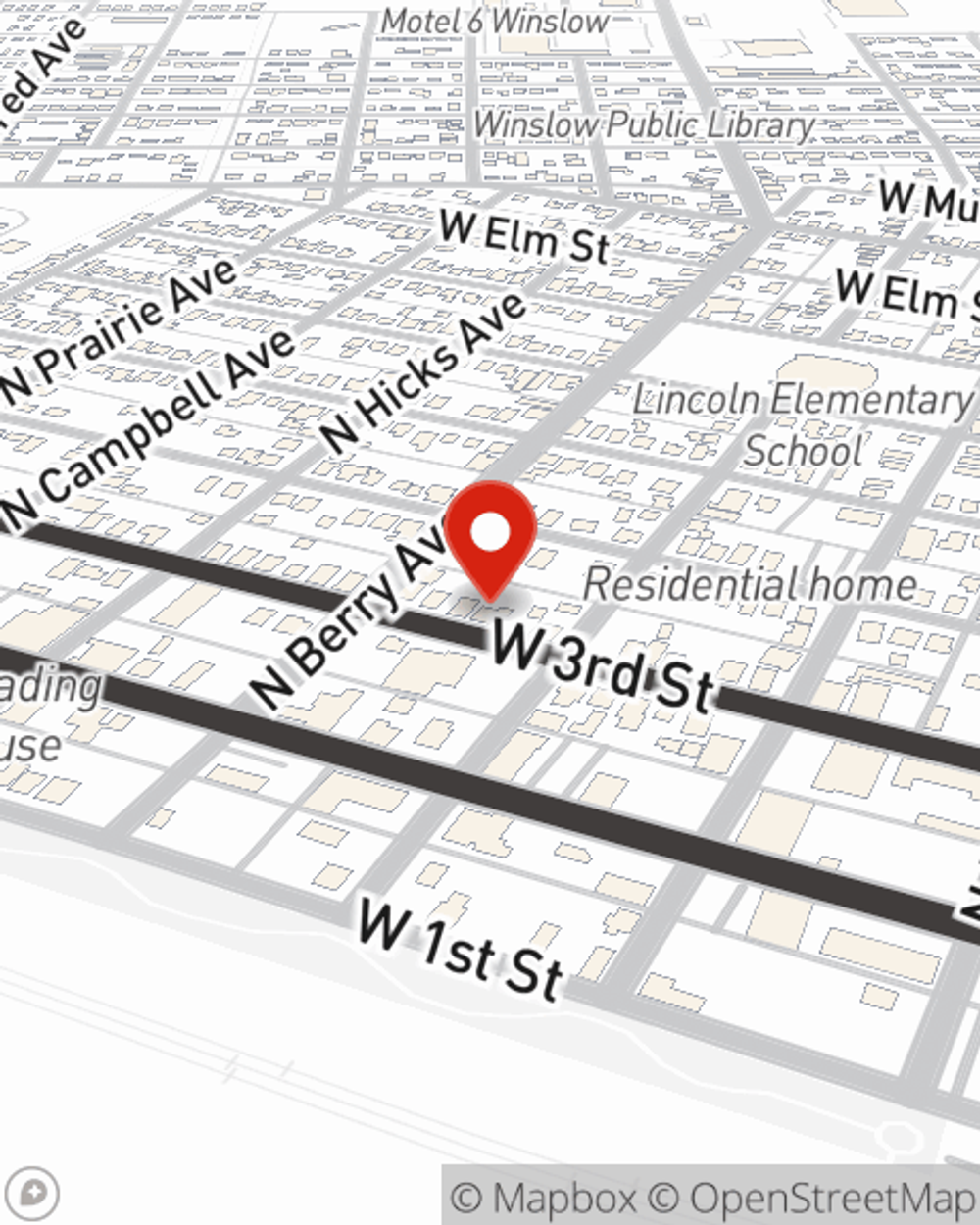

Homeowners Insurance in and around Winslow

Looking for homeowners insurance in Winslow?

Help cover your home

Would you like to create a personalized homeowners quote?

With State Farm's Insurance, You Are Home

When you’re tired from another long day, there’s nothing better than coming home. Home is where you chill out, recharge and relax. It’s where you build a life with the ones you love.

Looking for homeowners insurance in Winslow?

Help cover your home

Protect Your Home Sweet Home

Your home is the cornerstone for the life you hold dear. That’s why you need State Farm homeowners insurance, just in case life goes wrong. Agent Shirley Light can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Shirley Light, with a no-nonsense experience to get high-quality coverage for your homeowner insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

Don’t let worries about your home keep you up at night! Visit State Farm Agent Shirley Light today and find out how you can save with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Shirley at (928) 289-3200 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.

Shirley Light

State Farm® Insurance AgentSimple Insights®

The importance of safety glasses and when to wear them

The importance of safety glasses and when to wear them

Learn about the importance of wearing eye protection, the different types and features that can help increase your safety and prevent eye injury.

Ways to help add value to your home

Ways to help add value to your home

Discover new ways to get the most home value, from complete home renovations to simple improvements.