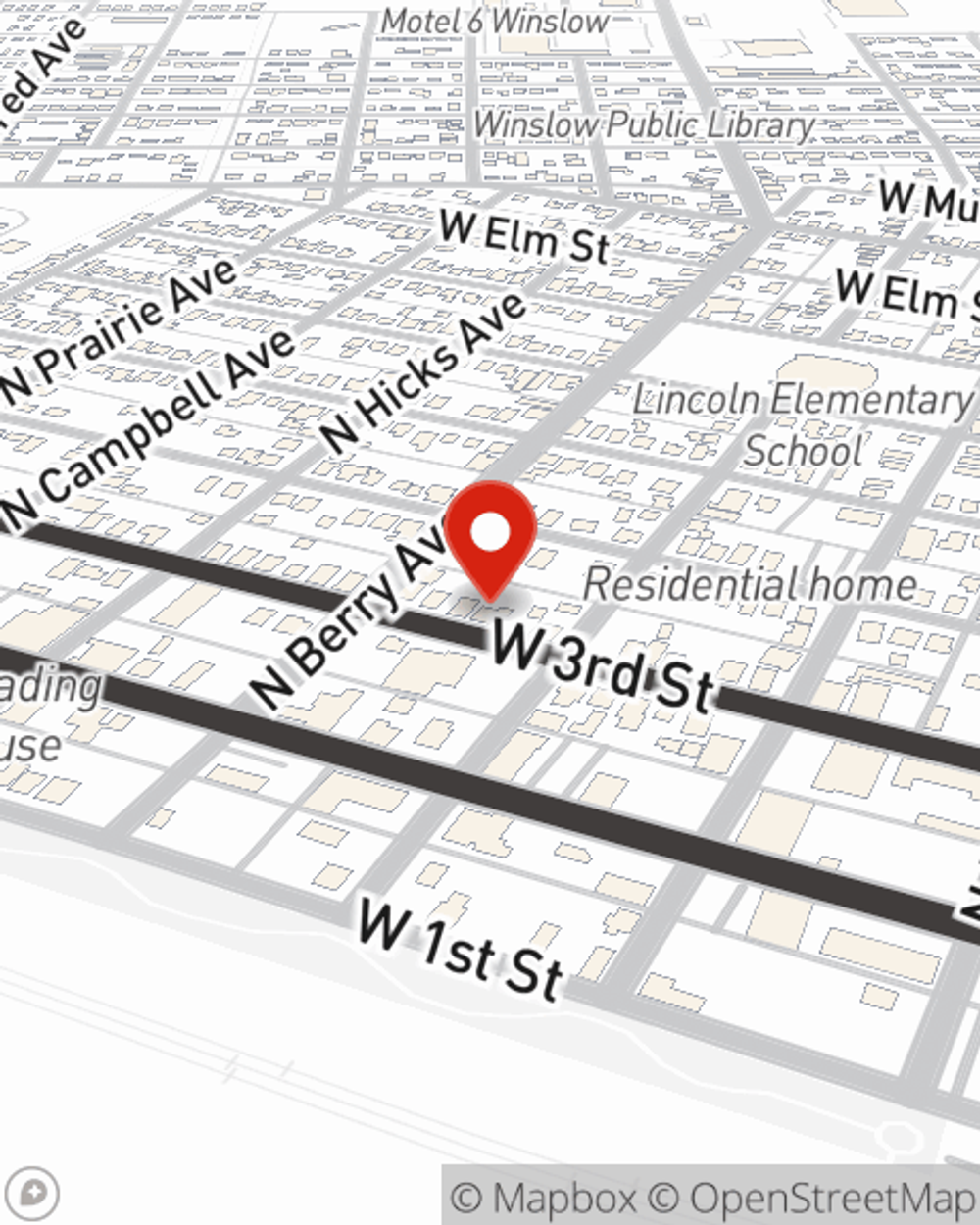

Condo Insurance in and around Winslow

Condo unitowners of Winslow, State Farm has you covered.

Protect your condo the smart way

Your Stuff Needs Protection—and So Does Your Condominium.

When considering different liability amounts, coverage options, and savings options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo unit but also your personal belongings within, including pictures, appliances, sound equipment, and more.

Condo unitowners of Winslow, State Farm has you covered.

Protect your condo the smart way

Agent Shirley Light, At Your Service

When a windstorm, an ice storm or a hailstorm cause unexpected damage to your townhome or someone gets hurt at your residence, having the right coverage is necessary. That's why State Farm offers such great condo unitowners insurance.

Intrigued? Agent Shirley Light can help explain your options so you can choose the right level of coverage. Simply call or email today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Shirley at (928) 289-3200 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Shirley Light

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.